THE FUND[1]

Background

Bretton Woods is a name we have all heard of since high school history class, but do we remember what took place there? Quite a lot happened there, but what we are focused on now is what was initially called the United Nations Monetary and Financial Conference. At that meeting five institutions were created; we are only concerned with two, the International Monetary Fund (IMF) and the World Bank (officially the International Bank for Reconstruction and Development) which were conceived in July 1944 and formally organized in July of the following year.

G. Edward Griffin explains the façade and the reality of these two entities, “The announced purpose of these organizations were admirable. The World Bank was to make loans to war-torn and underdeveloped nations so they could build stronger economies. The International Monetary Fund was to promote monetary cooperation between nations by maintaining fixed exchange rates between their currencies. But the method by which these goals were to be achieved was less admirable. It was to terminate the use of gold as the basis of international currency exchange and replace it with a politically manipulated paper standard. In other words, it was to allow governments to escape the discipline of gold so they could create money out of nothing without paying the penalty of having their currencies drop in value on world markets.”[2]

Both the IMF and the World Bank are based in Washington, D.C. The IMF always has a European head while the World Bank’s leader is an American.

Initially, as noted, they were set up to fund the reconstruction of Europe and Asia after World War II, and then to build infrastructure and provide for the basic needs of people in the developing world. But in the 1960s, the World Bank shifted the focus of its loans from infrastructure to social services and other social justice[3] sectors.

As Griffin points out, “The International Monetary Fund appears to be a part of the United Nations, much as the Federal Reserve System appears to be part of the United States government, but it is entirely independent. It is funded on a quota basis by its member nations, almost 200 in number. The greatest share of capital, however, comes from the more highly industrialized nations such as Great Britain, Japan, France, and Germany. The United States contributes the most, at about twenty percent of the total. In reality, that twenty percent represents about twice as much as the number indicates, because most of the other nations contribute worthless currencies which no one wants. The world prefers dollars.

One of the routine operations at the IMF is to exchange worthless currencies for dollars so the weaker countries can pay their international bills. This is supposed to cover temporary “cash-flow” problems. It is a kind of international FDIC[4] which rushes money to a country that has gone bankrupt so it can avoid devaluing its currency. The transactions are seldom paid back.”

“Although escape from the gold-exchange standard was the long-range goal of the IMF, the only way to convince nations to participate at the outset was to use gold itself as a backing for its own money supply – at least as a temporary expedient.”[5]

So now instead of IMF loans for concrete projects – infrastructure, private industry, and other sound investments — the loans are going to governments in pursuit of “humanitarian goals.” Actually much of the money ends up in the pockets of the leaders and bureaucrats. Some, very little, is actually used for aid to the starving citizens of those countries.

Part 1, Purpose

The International Monetary and Financial Committee (IMFC)[6][7] has now requested that the IMF review “its mandate to cover the full range of macroeconomic and financial sector policies that bear on global stability,” and to report back to the Committee next year. On January 22, 2010, the International Monetary Fund’s Strategy, Policy, and Review Department (in consultation with the Legal Department) prepared an overview of the Fund’s Mandate and what it saw as the problems of control facing the Fund and how they could tweak the mandate “without the politically taxing process of amending the Articles of Agreement.”

What that means is how to make the IMF far more powerful than it already is without having the members vote on the changes, since the members would not be willing to make such far-reaching and drastic changes. For instance, regarding financial data of IMF members:

First, it (the IMF) has only limited and episodic access to supervisory data (e.g., in the context of FSAPs (Financial Sector Assessment Program), and members often decline to provide systemically relevant information on grounds of confidentiality. Second, the Fund has no authority to require confidential data on entities such as large complex financial institutions (LCFIs), a few dozen of which make up the basic plumbing of global finance. The reason is that Article VIII, Section 5 provides that members are under no obligation to furnish information that exposes individual corporations. Yet understanding the linkages between LCFIs, and changing patterns and concentrations in exposure, is crucial to any institution claiming to be a guardian of global stability. As amendment of the Articles to require such disclosure is unlikely to find broad support, alternative arrangements will be needed.

Already we see that the IMF is facing a brick wall if they have to go to the members for permission, but not if they go around the members via executive decisions. The IMF sees itself as a “guardian of global stability,” that is literally how they put it; yet a normal person, even one with little economics savvy, would consider them just the opposite. What the IMF, World Bank, the Federal Reserve, Bank of England, etc. are doing is working toward global instability – not stability – until they can wrest controlling power. Then they will set up stability in a world of masters (them) and slaves (us).

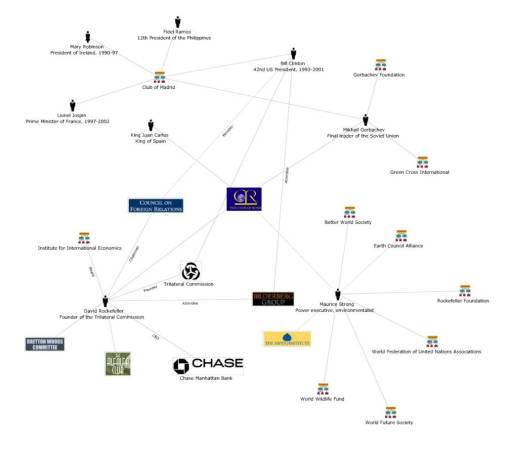

You don’t think so? Here is an interview of Maurice Strong, one of the world’s richest men, the Secretary-General of the 1992 Earth Summit in Rio, President of the World Federation of United Nations, and on and on, speaking to journalist, Daniel Wood of WEST Magazine:

Each year the World Economic Forum convenes in Davos, Switzerland. Over a thousand CEOs, prime ministers, finance ministers, and leading academics gather in February to attend meetings and set the economic agendas for the year ahead. What if a small group of these word leaders were to conclude that the principle risk to the earth comes from the actions of the rich countries? And if the world is to survive, those rich countries would have to sign an agreement reducing their impact on the environment. Will they do it? Will the rich countries agree to reduce their impact on the environment? Will they agree to save the earth?

The group’s conclusion is “no.” The rich countries won’t do it. They won’t change. So, in order to save the planet, the group decides:isn’t the only hope for the planet that the industrialized civilizations collapse? Isn’t it our responsibility to bring that about?

This group of world leaders form a secret society to bring about a world collapse. It’s February. They’re all at Davos. These aren’t terrorists – they’re world leaders. They have positioned themselves in the world’s commodity and stock markets. They’ve engineered, using their access to stock exchanges, and computers, and gold supplies, a panic. Then they prevent the markets from closing. They jam the gears. They have mercenaries who hold the rest of the world leaders at Davos as hostage. The markets can’t close. The rich countries…?[8]

Or as Griffin puts it in Creature, “Destruction of the economic strength of the industrialized nations is merely a necessary prerequisite for ensnaring them into the global web. The thrust of the current ecology movement is directed totally to that end.”[9]

Capital flows

(I)t seems appropriate that Fund surveillance cover more effectively capital flows and related policies. Granting the Fund the authority to approve — or not — capital controls would require amending the Articles, which is never an easy process, especially on an issue on which the membership is highly divided.

As will be shown further into this paper, the IMF wants capital to flow from the U.S. and other First World Countries to Third World Countries – from the “haves” to the “have nots.” Capital flow is not meant to promote technological or industrial growth, but will be used for welfare in order to create dependency; the IMF does not want the poor people of the world becoming strong and healthy economically or physically.

Role in Low Income Countries

In particular, the Fund may need to expand its role as a provider of insurance against global volatility and other shocks, including from the effects of climate change.[10]

Even though the global warming scare has been shown as a fraud to promote onerous legislation like “cap and trade,” to shut down industry in the U.S., and to prevent people from using their private property, all of these actions are still being carried out so the IMF pretends there is still a basis for it.

Also, Agenda 21 – the Earth Charter, calls for the redistribution of wealth between rich and poor countries as seen in section 2.1 on page 19:

“In order to meet the challenges of environment and development, States have decided to establish a new global partnership. This partnership commits all States to engage in a continuous and constructive dialogue, inspired by the need to achieve a more efficient and equitable world economy, keeping in view the increasing interdependence of the community of nations and that sustainable development should become a priority item on the agenda of the international community….

Economic policies of individual countries, and international economic relations both have great relevance to sustainable development. …Neither will it gather momentum if the developing countries are weighted down by external indebtedness…. Therefore, it is the intent of Governments that consensus-building at the intersection of the environmental and trade and development areas will be ongoing in existing international forums, as well as in the domestic policy of each country.”

Reserves

The build-up of international reserves as a buffer against shocks is widely expected to resume as the crisis fades and to some extent already has. While such accumulation can be costly for surplus and reserve-issuing countries alike, there are three underlying problems. First, there are concerns about the availability of international liquidity in times of crisis, prompting a precautionary reserve buildup, especially when heavy capital inflows threaten to overwhelm emerging markets. Second, there is no automatic adjustment of current account imbalances, neither surplus countries nor reserve-issuing deficit countries facing pressure to adjust. Third, the concentration of reserves in US dollars reflects the absence of close substitutes as a global store of value and anchor for asset and price stability. The Fund’s overarching responsibility to promote the effective operation of the international monetary system requires that it seek solutions to the above problems. While it may draw on all its powers for this purpose, a rarely discussed one is to be found in Article VIII, Section 7, which calls on members to collaborate on reserve policies with the objective of “better international surveillance of international liquidity and making the special drawing right the principal reserve asset in the international monetary system.” Consideration may need to be given to reviving this forgotten provision as a basis for action, not least because official reserves have become large enough relative to private flows as to have significant—and potentially destabilizing—market impact from a sudden portfolio reallocation.

A key problem with using a national currency as the main global reserve asset is that instability in its value translates to the entire system. The problem can be ameliorated by the presence of several suppliers of reserve assets—the euro has emerged as an alternative to the dollar and at some point in the future the yen and, further out, the renminbi[11] might also—or by globally-issued reserves. Given the network externalities associated with a single reserve asset, neither solution is likely to emerge spontaneously any time soon. Thus, it may be necessary to consider giving content to members’ obligation, under Article VIII, Section 7, “to collaborate with the Fund and with one another with regard to policies on reserve assets” so as to facilitate a smooth transition to a more stable system.

The IMF is making the point that the U.S. Dollar should no longer be used as the main global reserve asset. While they are considering using the yuan, they actually have other plans:

A global currency. The SDR is not a currency but a right to access freely usable currencies in case of balance of payments difficulties; its stability rests on that of its component currencies. A more far reaching approach would be to introduce a new global reserve currency, similar to Keynes’ bancor[12], issued by an institution with an impeccable balance sheet and a governance structure that gives confidence that it can function as a prudent and independent world central bank. A global reserve currency that is not associated with the economic developments of any particular country would remove the vulnerabilities associated with reserve accumulation in national currencies and could remedy the lack of automatic adjustment. The operational and political challenges, however, would be huge. As such, the idea is clearly one for the long term.

While the IMF’s Overview writers predict only positive effects of a global currency, what about the fact that there is no basis in gold or oil or precious metals for their currency? Without something to define the value of a currency, some standard on which to measure it, it then becomes the monetary equivalent of moral relevancy – it’s worth changing with the whims of the power elite.

That is a quick look at the Overview of the IMF’s Mandate.

Part 2, The Lawyers; or how to get around the rules

A month to the day after that was submitted, “The Fund’s Mandate – The Legal Framework” was offered up to accompany the Overview. Interestingly, it begins with a note on the specialization of the organization and states,

While, at a certain level of abstraction, it may be said that all international organizations have been established to enhance human welfare, the assumption underlying the design of the post-war international architecture was that each organization would make its own distinct contribution to that objective; … since all of the enumerated purposes are of an economic nature, it has been understood that, unlike some other organizations, the Fund is precluded from using its powers for political objectives. (italics mine)

It would be hard to see any other use of its powers. The IMF is one of the tentacles of Agenda 21 which is totally political – working toward a totalitarian socialistic world government through the redistribution of wealth.

The powers conferred upon the Fund under the Articles can be divided into three categories: (a) oversight powers,relating primarily to the Fund’s responsibility to monitor and promote the observance of members’ obligations under the Articles; (b) the power to provide financial assistance; and (c) advisory powers. Consistent with the principles of national sovereignty (italics mine) and specialization noted above, the powers conferred upon the Fund are generally limited to those explicitly identified in the Articles.

But they go onto state:

Accordingly, while the key parameters of the Fund’s mandate are established in the Articles of Agreement, it may be said that the operational content of the Fund’s mandate has been updated over time by Executive Board decision.

In other words, the Executive Board has made many changes that the members never would have allowed.

The legal department gripes that regarding domestic policies, including financial sector policies, member obligations are limited in two important respects:

- First, the relevant text reveals that these obligations (Article IV, Section 1 (i) and (ii)) are of a “soft” nature: taking into account the fact that members retain great sovereignty in terms of the conduct of their domestic policies, they are only required to exercise “best efforts” in this area. In contrast, those obligations that relate to members’ external policies, including exchange rate policies (Article IV, Section 1 (iii) and (iv)), are of a “hard” nature—requiring the achievement of results rather than just the exercise of best efforts—reflecting the direct international impact of these policies.

- Second, members’ obligations respecting domestic policies only require members to take action to promote their own domestic stability. As long as a member is implementing domestic policies in a manner that ensures such stability, it is under no obligation to change these policies, even if a change would further enhance the stability of the overall exchange rate system.

They are not happy that the members “retain great sovereignty in terms of the conduct of their domestic policies” or that the members’ obligations are to promote their own domestic stability – not that of the rest of the world (and they say this). In order to get around the Articles in the Mandate that they find to be too restricting, the legal department suggests that the constraints could be addressed through the adoption of decisions by the Executive Board.

What they are saying is that even though a country is being fiscally responsible, if the IMF decides that their domestic policies are impacting the “the balance of payments of other countries, even where this effect is not transmitted through the member’s own balance of payment,” then the IMF could step in and make those fiscally responsible countries change their fiscally conservative policies.

In order for the type of situation identified in paragraph 15 above to be made central to bilateral surveillance, it would be necessary to amend Article IV itself. Such an amendment could reconsider the primacy that is given to exchange rate policies over domestic policies and, in that context, expand members’ obligations relating to domestic policies in a manner that would require a member to adjust its domestic policies to support systemic stability—even if the domestic policies in question are not undermining the member’s own domestic stability. This would represent, however, a significant surrender of national sovereignty. (italics mine)

Much of the review is working out how the IMF can broaden its surveillance scope of countries. Right now member countries are under no obligation to furnish information in “such detail that the affairs of individuals or corporations are disclosed.” The IMF would like to change this without having to amend the Agreement (remember member countries are unlikely to want to give up either more information or their sovereignty), so they are looking to the Executive Board to make the necessary changes and to read the Articles in a new light to change “expectations” of information from members to solid demands.

And now to the Reserve Policies of Members:

“[e]ach member undertakes to collaborate with the Fund and with other members in order to ensure that the policies of the member with respect to reserve assets shall be consistent with the objectives of promoting better international surveillance of international liquidity and making the special drawing right the principal reserve asset in the international monetary system.” (italics mine)

As stated by the Legal Department, this provision was one of several new provisions that “were designed to reduce the role of gold and to strengthen the role of SDRs in the international monetary system,” or to put it another way, to have fiat money as the sole reserves.

The Fund would also need to provide further guidance on the meaning of the obligation of members to collaborate towards the objective of making the SDR the principal reserve asset in the international monetary system. Two important features of this objective should be noted. First, making the SDR the principal reserve asset of the international monetary system is identified as an objective, but not necessarily as a result that has been—or is required to be—achieved.

In discussing the Oversight of International Capital Movements, the Legal Department admits that while they want a more active role in overseeing members’ regulation of these movements, designing “an appropriate approach is far more complex and nuanced” than it was when they were just controlling current payments and transfers.

They admit that free capital movements “help channel resources to their most productive uses and increase economic growth and welfare.” But they then blame the free markets for the recent crises.

With that, the Legal Department says it would be open for the Fund to establish policies (which they would call “recommendations” for a softer sell), that provide guidance to members;

as to: (a) what conditions should be in place before a member liberalizes its capital account, and (b) when the imposition of controls on outflows or inflows may be an appropriate response to balance of payments or macroeconomic pressures. In the conduct of bilateral surveillance, the Fund would assess the extent to which members’ actions are consistent with these recommendations. The Fund could also take up the systemic role of capital movements—and the impact of controls on such movements—in the context of multilateral surveillance.

In other words, the IMF would decide what the countries’ fiscal and economic policies MUST be.

Summary

“Power tends to corrupt, and absolute power corrupts absolutely.”

— Lord Acton

That sentence sums up this document very well. What happens when a group of powerful people decide that they do not have enough wealth and power and need to find more, is what happened here, or rather at Bretton Woods. Harry Dexter White, Assistant Secretary of the U.S. Treasury and John Maynard Keynes were the designers of the IMF and World Bank on behalf of themselves and their cronies in finance and government in the U.S. and Europe.

These same people also believe that what the world needs now is global governance. As a former U.S. Foreign Service Officer put it in his book, Ecology and the Politics of Scarcity Revisited, the Unraveling of the American Dream, “… the golden age of individualism, liberty, and democracy is all but over. The need for a world government with enough coercive power over fractious nation states to achieve what reasonable people would regard as the planetary common interest has become overwhelming.”[13]

I have quoted G. Edward Griffin a number of times, let me add one more because he puts his finger on it so well. “Although most of the policy statements of the World Bank (and the IMF by extension, author’s note) deal with economic issues, a close monitoring of its activities reveal a preoccupation with social and political issues. This should not be surprising considering that the Bank was perceived by its founders as an instrument for social and political change. The change which it was designed to bring about was the building of world socialism, and that is exactly what it is accomplishing today.”[14]

Remember, the IMF doesn’t want the poor people of the world becoming strong and healthy economically or physically. What they want is control of the world – of both the rich and the poor countries – but they have to make the rich countries far poorer first (through their economic policies) in order to control them.

Footnotes:

[1] While the International Monetary Fund is referred to as the IMF in most media sources, insiders call themselves the Fund.

[2] Griffin, G. Edward, The Creature from Jekyll Island, A Second Look at the Federal Reserve. America Media, 2009 edition, p. 86.

[3] A system of human rights operates in concert with the pursuit of “social justice,” which can be defined as law formulated to obtain government’s social objectives at the expense of individual liberty.

[4] Federal Deposit Insurance Corporation

[5] Griffin, op. cit., p. 89.

[6]Quote from the INTERNATIONAL MONETARY FUND, The Fund’s Mandate—An Overview, prepared by the Strategy, Policy, and Review Department.

[7] Bank-Fund Annual Meetings and in March or April at what are referred to as the Spring Meetings. The Committee discusses matters of concern affecting the global economy and also advises the IMF on the direction of its work. At the end of the meetings, the Committee issues a communiqué summarizing its views. These communiqués provide guidance for the IMF’s work program during the six months leading up to the next Spring or Annual Meetings. There is no formal voting at the IMFC, which operates by consensus.

[8] Wood, Daniel. “The Wizard of Baca Grande,” West Magazine, May, 1990, p. 35.

[9] Griffin, op. cit., p. 534.

[10] Note that this was written after the Climate Change scandal was exposed.

[11] The renminbi or the Chinese yuan is the official currency of the People’s Republic of China (PRC), with the exception of Hong Kong and Macau.

[12] John Maynard Keynes proposed a global bank, which he called the International Clearing Union. The bank would issue its own currency – the bancor – which was exchangeable with national currencies at fixed rates of exchange. The bancor would become the unit of account between nations, which means it would be used to measure a country’s trade deficit or trade surplus. (http://www.guardian.co.uk/commentisfree/2008/nov/18/lord-keynes-international-monetary-fund)

[13] Orphuls, William, Ecology and the Politics of Scarcity Revisited, the Unraveling of the American Dream, W.H. Freedman & Co., New York, 1992, p. 78.

[14] Griffin, op. cit., p. 95.